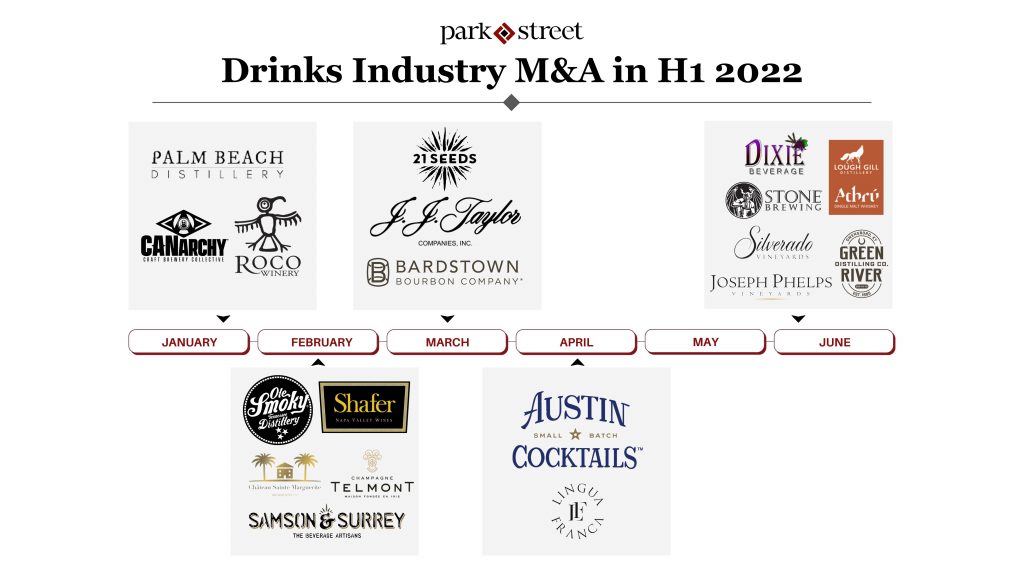

In the first half of 2022 mergers & acquisitions in the beverage alcohol space showed strong levels of activity with strategic buyers continuing to invest behind strong consumer trends including whiskey and RTDs.

There were 20 noteworthy beverage alcohol deals in H1 2022, representing an increase compared to the first half of 2021 when there were 16 deals. This series of deals was led by spirits (8) and wine (6) and distribution (3), while the beer category (2) and ecommerce (1) made up the remaining count.

While there were no standout strategic beverage industry players with multiple acquisitions this time around, there was a noticeable uptick in equity fund sales including Ole Smoky, Bardstown Bourbon Company, and Shafer Vineyards.

This period reflected a need to establish e-commerce compatibility and cater to high volume production of canned beverages. Notably, we also saw an emergence of private equity involvement in this space, with these firms continually reaching for wine producers.

Spirits Sector Deals

- Palm Beach Distillery Sells Majority Stake to Victor George Spirits

- Austin Cocktails Acquired by Constellation Brands

- Ole Smoky Sells Majority Stake to Private Equity Firm Apax Funds

- Samson & Surrey Acquired by Heaven Hill

- 21 Seeds Flavored Tequila Acquired by Diageo

- Bardstown Bourbon Company Acquired by Investment Firm Pritzker Private Capital

- Ireland’s Lough Gill Distillery Acquired by Sazerac

- Green River Distilling Acquired by Bardstown Bourbon Company

Wine Sector Deals

- Oregon winery Lingua Franca winery sold to Constellation Brands

- Roco Winery Acquired by Santa Margherita USA

- Château Sainte Marguerite Sells Majority Stake to Pernod Ricard

- Shafer Vineyards Sells to Korean Firm, Shinsegae Property for $250 Million

- Silverado Vineyards Acquired by Foley Family Wines

- Joseph Phelps Acquired by Moet Hennessy

Beer Sector Deals

- Canarchy Craft Brewery Purchased by Monster for $330 million

- Stone Brewing Acquired by Sapporo USA for $165 million

Distribution Sector Deals

- Major Brands Acquired by Breakthru Beverage Group

- J.J. Taylor’s Minnesota Beer Wholesaler Acquired by Breakthru Beverage Group

- Dixie Beverage Company’s Wine and Beer Business Acquired by Johnson Brothers

Ecommerce Sector Deals

- Provi Merges with SevenFifty for Expanded B2B Marketplace