Mergers & acquisitions in the beverage alcohol space continued apace in 2021 as strategic buyers adjusted their portfolios to meet demand for new consumer trends like canned cocktails, hard seltzer, and ecommerce.

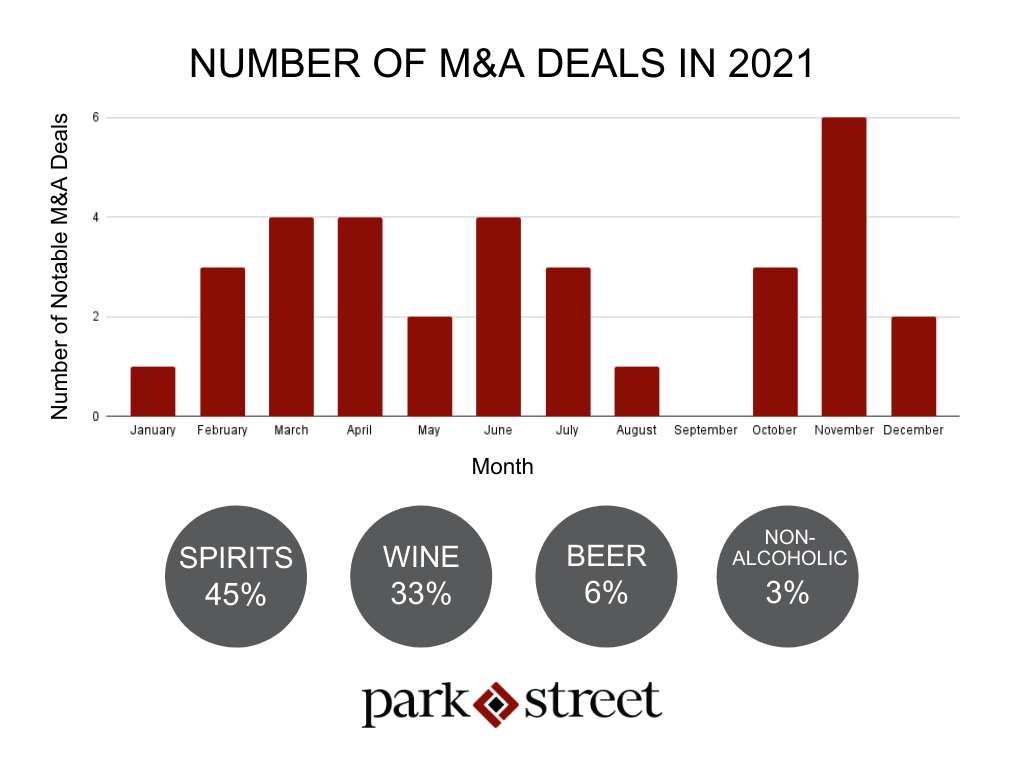

By our count, there were 33 U.S-centric beverage alcohol deals this year led by spirits (15), followed by wine (11), beer (2) and non-alcoholic beverages (1). There was also an uptick in M&A for e-commerce platforms, with four major deals going through this year. This is a clear shift from 2020 when M&A for e-commerce was quite low.

While smaller, bolt-on acquisitions have made up the vast majority of deals leading up to the pandemic, we have seen a noteworthy increase in major acquisitions this year. There were four deals–in both wine and ecommerce–that crossed the billion dollar milestone.

Below is a roundup of the most notable beverage alcohol M&A deals in 2021.

January

- MGP Ingredients Acquired Luxco for $475 Million

February

- Southern Glazer’s Wine & Spirits Acquired Epic Wine & Spirits

- LVMH Took 50% Stake in Jay-Z’s Armand De Brignac

- Uber Bought Alcohol Delivery Startup Drizly for $1.1 Billion

March

- Chatham Imports Made Equity Investment In Los Siete Misterios Mezcal

- Southern Glazer’s Wine & Spirits Made Equity Investment In ReserveBar

- Treasury Wine Estates Reach Long-Term Agreement with The Wine Group for Several Commercial Brands in its US Portfolio

- Diageo Acquired Lone River Ranch Water

April

- E&J Gallo Acquired RumChata Liqueur

- Diageo Acquired RTD Cocktail Brand Loyal 9

- Bollinger Acquired Ponzi Vineyards

- ZX Ventures Makes Investment in Canteen Spirits

May

- E&J Gallo Acquired LIQS Premium Cocktail Shots

- Constellation Acquired Minority Stake In Burston’s La Fête Du Rosé

June

- Constellation Brands Invested in “Breaking Bad” Stars’ Mezcal

- Uncle Nearest Debuted New $50 Million Venture Fund

- GoPuff Acquired Liquor Barn Retail Chain

- Delicato Family Wines Acquired Francis Ford Coppola Winery

July

- Constellation Brands Makes Ventures Investment in Adaptogen-Infused HOP WTR

- Ste. Michelle Wine Estates Sold for $1.2 Billion to Private Firm Sycamore Partners

- Constellation Acquired DTC-centric Empathy Wines

August

- Diageo To Acquire Mezcal Union

October

- Jaja Tequila Forms Partnership with Proximo Spirits

- Pernod Ricard Takes Stake in Abasolo Mexican Whisky

- Stoli Group Acquires 50% Share of Miraval

November

- The Wine Group Takes Stake in Rancho La Gloria

- Phillips Distilling Company Agrees to Acquire Leroux Brandy & Liqueurs and Kamora Coffee from Beam Suntory

- ReserveBar Acquires Minibar Delivery

- Amber Beverage Group Acquires Walsh Whiskey

- Vintage Wine Estates Acquires ACE Cider

- Treasury Wine Estates to Acquire Frank Family Vineyards

December

- Cannabis Company Tilray Acquires Breckenridge Distillery

- Foley Family Wines Buys Chateau St. Jean

For the latest list of mergers and acquisitions, along with analysis of major players and buyer motivation, check out Park Street’s 2023 Beverage Alcohol M&A Overview.